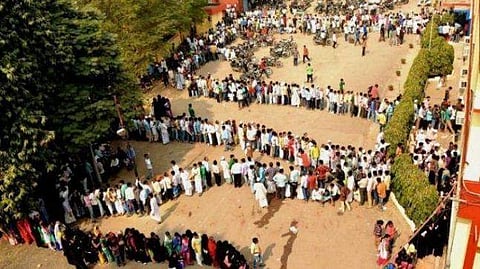

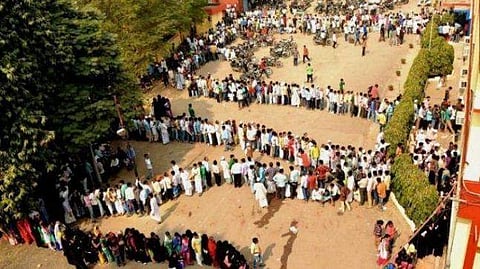

It's been three years since demonetisation was announced by the Prime Minister Narendra Modi to get rid of black money and it seems that urban India is still in love with the move, says a study by Velocity MR. The study found that more than 70 per cent Indians think that demonetisation has played an important role in curbing terrorism as it has dealt a huge blow to the funding of terror in states like Jammu & Kashmir as well as left-wing extremist violence across several states.

The national study that had a sample size of 2,100 respondents and covered Delhi, Kolkata, Mumbai, Bangalore, Hyderabad Chennai, and Pune. "During this note-ban period, the majority of the population shifted to digital payment methods. The study found that PayTM, GPay and PhonePe were leading the list in terms of high recall value in the digital transaction apps. While 74 per cent of the respondents said that demonetisation has driven the country towards a cashless society, every one in two people complained of incomplete transactions and low-speed internet when it came to these e-wallets/UPI apps," said the study.

“From being primarily a cash-obsessed economy, India’s digital transformation story is new but exciting. The evolution of the industry has been triggered by increasing internet and smartphone penetration," said Jasal Shah, Managing Director and CEO of Velocity MR "As digital consumer behaviours change, so should the technologies and services. To lure the consumers, the digital wallets rolled out lucrative offers and cashback to get customers on board using the payment channel," he added. The number of people availing mutual funds and investments through apps has also increased in the past years.